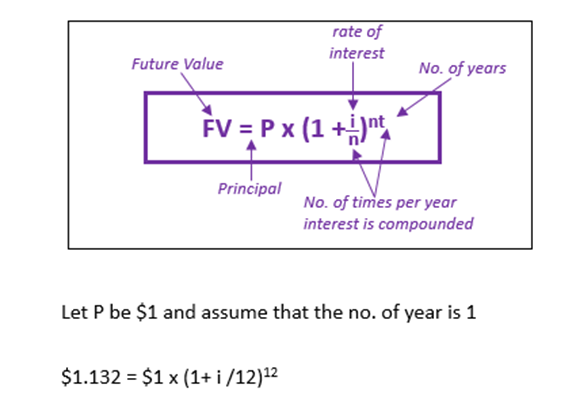

The nominal interest rate is also defined as a set interest rate. This interest works on the principle of simple interest and does not take into account periods of compound interest. … For example, a nominal annual interest rate of 12% on a monthly interest basis means an interest rate of 1% per month (on a compound interest basis).

In this case, what formula is used to calculate the nominal rate? How to calculate the nominal rate of return

- Subtract the original investment amount (or principal investment amount) from the current market value of the investment (or at the end of the investment period).

- Take the result from the numerator and divide it by the original investment amount.

How do you calculate the real and nominal interest rate? The real interest rate u2248 the nominal interest rate u2212 the inflation rate. To find the real interest rate, take the nominal interest rate and subtract the inflation rate. For example, if the interest rate on a loan is 12 percent and the inflation rate is 8 percent, the real return on that loan is 4 percent.

Advanced How do I find the nominal interest rate with a financial calculator? To calculate the nominal rate from a known effective rate:

- Enter the effective rate and press SHIFT, then EFF%.

- Enter the number of interest periods and press SHIFT, then P/YR.

- Calculate the nominal rate by pressing SHIFT, then NOM %.

What is an example of a nominal interest rate? The nominal interest rate (or monetary interest rate) is equal to the percentage increase in the money you pay the lender for using the money you borrowed. For example, imagine that a year ago you borrowed $100 from the bank at 8% interest. … In our previous example, the lender earned 8% or $8 on the $100 loan.

How to calculate the nominal interest rate in Excel?

Excel NOMINAL function

- Summary. …

- Get the annual nominal interest rate.

- The nominal interest rate.

- =NOMINAL (effect_rate, number_prog.)

- The effect_rate is the effective annual interest rate.

What is an equivalent nominal rate? A nominal rate of interest, as stated, usually accrues more than once a year. … If two interest rates have the same effective rate, we say they are equivalent.

Is the nominal rate the same as the annual rate? The nominal interest rate is the cost of the loan service provided by the banking institution; The annual interest rate includes the rest of the actual cost of the loan. When a bank lends money, it charges an interest rate for that service. And that money also generates associated costs.

How to calculate the real interest rate?

The “real interest rate” is the interest rate adjusted for inflation. To calculate the real interest rate, you subtract the inflation rate from the nominal interest rate. In mathematical terms, we would put it this way: the real interest rate is equal to the nominal interest rate minus the inflation rate.

Also How do I know the interest rate? How to calculate the interest rate

- Step 1: To calculate the interest rate, you need to know the formula for interest I / Pt = r to get your rate. …

- I = The amount of interest paid in a certain period of time (month, year, etc.)

- P = principal amount (money before interest)

- t = the period of time involved.

- r = interest rate in decimal format.

How do I calculate the real interest rate, the nominal interest rate, and inflation?

“The real interest rate is the interest rate adjusted for inflation. To calculate the real interest rate, you subtract the inflation rate from the nominal interest rate. In mathematical terms, we would put it this way: the real interest rate is equal to the nominal interest rate minus the inflation rate.

How do we find out the interest rate? Using the interest rate formula, we get the interest rate, which is the percentage of the principal charged by a lender or bank to a borrower for the use of their assets or money over a period of time. Interest Rate Formula Interest Rate = (Simple Interest × 100) / (Principal Amount × Time).

What is the nominal interest rate?

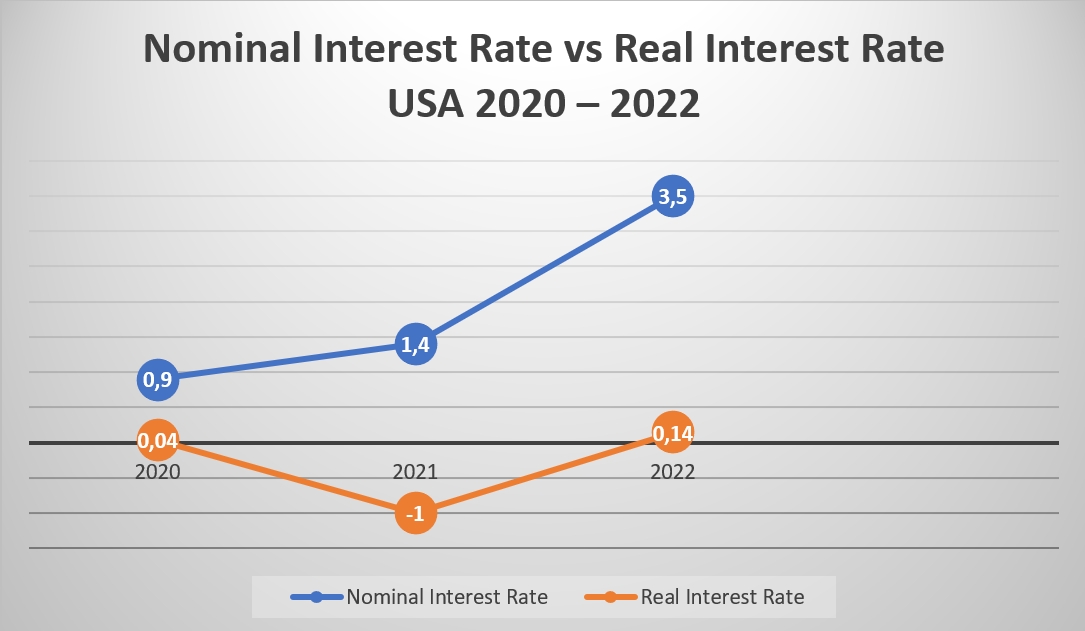

The nominal interest rate is the rate you pay on the loan. The real interest rate is the nominal interest rate, adjusted for inflation. The demand curve for credit is downward because. a higher real interest rate reduces the profits of the borrowing firm and therefore its willingness to borrow.

How do you calculate the real interest rate with CPI and the nominal interest rate? 1) Short-term real interest rates are calculated by subtracting the current 12-month CPI inflation rate from the nominal three-month interest rate. Long-term real interest rates are calculated by subtracting the current 12-month CPI inflation rate from the 10-year government bond yield.

How do I find the annual percentage interest rate? To calculate the APR, follow these steps:

- Calculate the interest rate.

- Add administrative fees to the amount of interest.

- Divide by the loan amount (principal)

- Divide by the total number of days in the term of the loan.

- Multiply everything by 365 (one year)

- Multiply by 100 to convert to interest.

How do I find the annual simple interest rate?

Simple interest is calculated using the following formula: SI = P × R × T, where P = principal, R = interest rate in % per annum and T = time, usually calculated as number of years. The interest rate is expressed as a percentage r% and should be written as r/100.

What is the nominal interest rate and the real interest rate? The real interest rate is the interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real return to the lender or investor. The nominal interest rate refers to the interest rate without regard to inflation.

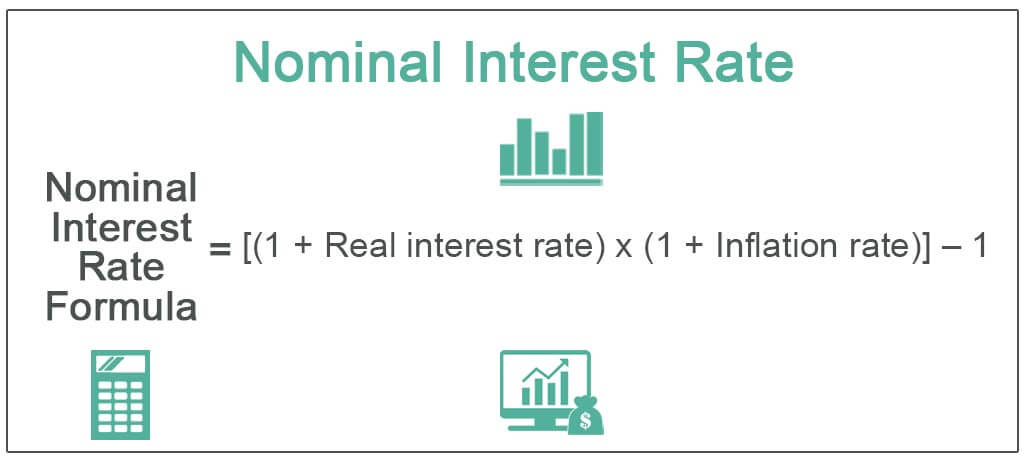

How do I calculate the Fisher equation?

Named after the American economist Irving Fisher, it can be expressed as the real interest rate ≈ nominal interest rate – inflation rate. More formally speaking, where r equals the real interest rate, i equals the nominal interest rate, and π equals the inflation rate, Fisher’s equation has the form r = i – π.

What is the nominal interest rate if the real interest rate is 5% and the expected inflation rate is 3.5%? According to the Fisher effect, if inflation rises, the nominal interest rate rises. If the real interest rate is 5% and the inflation rate is 3%, the nominal interest rate is 8%.

What is the real interest rate if the nominal rate is 10% and the inflation rate is 5%?

3%. The real interest rate (r%) can be calculated using Fisher’s equation, which consists of the nominal interest rate (n%)…

What is the real interest rate if the nominal interest rate is 7 and the inflation rate is 5? If the nominal interest rate is 7 percent and the inflation rate is 5 percent, the real interest rate is 12 percent. There have been long periods in the history of the United States when most prices have fallen.

What do real interest rates take into account and what do nominal interest rates not take into account?

The nominal interest rate or coupon rate is the actual price that borrowers pay to lenders, without regard to any other economic factors. Real interest rate accounts for inflation, giving a more accurate picture of a borrower’s purchasing power after the position is repaid.

Why should investors know the difference between nominal and real interest rates quizlet? Why should investors know the difference between nominal and real interest rates? Recognize the impact of inflation.

What is the relationship between a lower nominal rate and a higher real interest rate?

When nominal interest rates are higher than the rate of inflation, real interest rates are positive. When nominal interest rates are below the rate of inflation, real interest rates are negative. This is important to understand when comparing interest rates on investments to the current rate of inflation.

What is the effective annual interest rate if the nominal interest rate is 6% charged monthly?

Calculation. For example, a nominal interest rate of 6% charged monthly is equivalent to an effective interest rate of 6.17%.